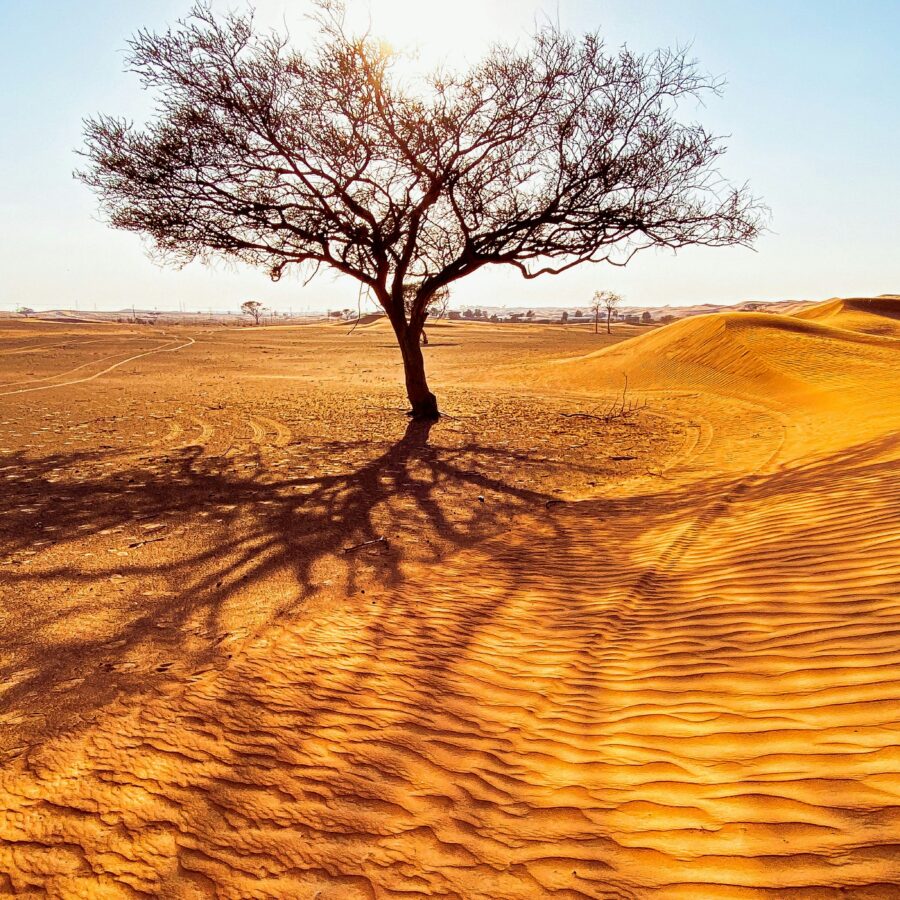

Climate adaptation concepts for urban and rural areas

A quick intro

Climate adaptation finance is the process of channeling investments into solutions that help societies, businesses, and ecosystems withstand and thrive despite the impacts of climate change. While mitigation finance tackles the causes of climate change by reducing greenhouse gas emissions through renewable energy, efficiency, or carbon storage, adaptation finance addresses its consequences, by funding measures such as resilient infrastructure, drought-resistant agriculture, or improved water systems.

Adaptation finance is increasingly vital as climate risks become more frequent and severe. It is not only about managing risks but about transforming them into opportunities. Well-designed adaptation projects protect lives and assets, improve creditworthiness, and create stable revenue streams. For financial institutions and investors, this means enhanced risk-adjusted returns, access to new markets, and alignment with an evolving regulatory and investment landscape.

Yet the adaptation finance gap remains large: while global needs are estimated at $130–415 billion per year by 2030 in developing countries, current flows fall far short. Closing this gap requires innovative financing instruments, partnerships across public and private sectors, and enabling policies that direct capital where it is needed most.

Our mission:

We strive to be a thought leader in the fast-emerging field of climate adaptation finance. We draw on our deep experience in finance and long-standing partnerships with financial institutions and investors to shape adaptation into a mainstream investment practice. We help our clients unlock resilience, align capital with climate realities, and create sustainable long-term value.