Blended Finance for Nature-Based Solutions: Insights from the Nairobi Workshop

On Thursday, 27 November 2025, Rebel Advisory East Africa, Convergence Blended Finance and the Embassy of the Kingdom of the Netherlands in Kenya, came together for a high-level workshop and networking event in Nairobi to explore practical, scalable approaches to financing nature-based solutions (NbS).

Context and Purpose

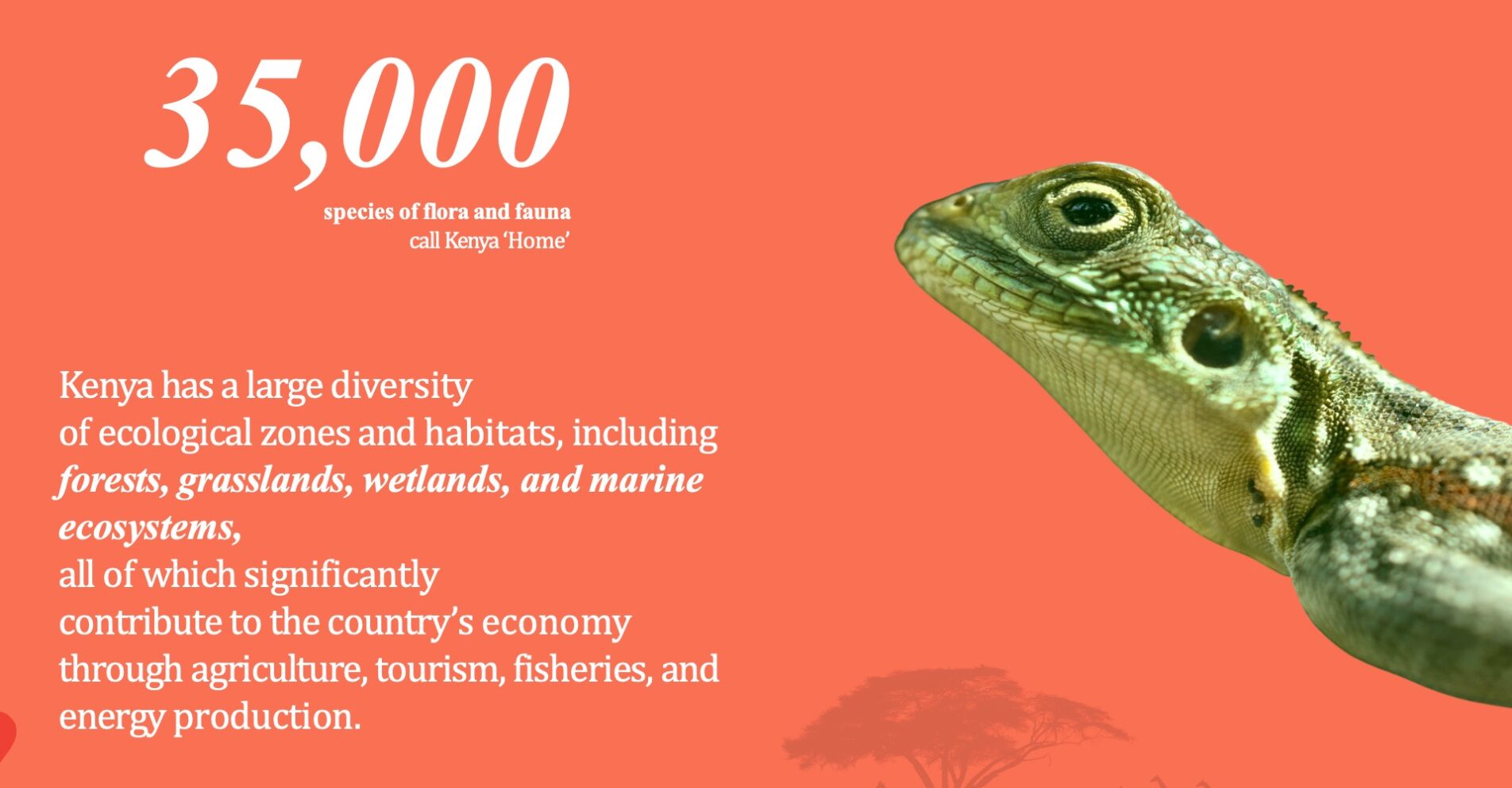

The links between climate, water, agriculture, and social impact are becoming increasingly clear. Nature-based solutions offer a vital pathway to resilience and sustainability.

At Rebel, we go beyond traditional strategic and financial advisory. We drive meaningful change through involving a variety of partners and co-creating new projects and initiatives. With the mission to transform sectors and realise sustainable impact.

Rebel’s recent report for the Kenya Bankers Association, in collaboration with GIZ and WWF, explored nature-related financing and investment opportunities for commercial banks in Kenya. The findings are promising: Kenya has huge potential to build a nature-positive economy. Still, nature is a relatively new asset class, and many projects need blended finance to be viable.

Realising this potential requires strong cross-sector collaboration, with each stakeholder bringing their expertise. The workshop and networking event are a key step in this direction and we are excited to contribute.

“At Rebel, our ambition is to transform nature into a viable asset class, bridging the gap between innovative projects and the finance needed to scale them. By catalysing partnerships across sectors, we can unlock private capital and drive measurable environmental impact”

– Ingwell Kuil, Director, Rebel Advisory East Africa

Setting the Scene

In his opening remarks, Aakif Merchant, Director and Head of Africa, Convergence Blended Finance, noted:

“To scale nature-based solutions, we need a robust pipeline of investable projects. Blended finance plays a critical role in de-risking these opportunities and demonstrating that environmental impact and financial returns can go hand in hand”

– Aakif Merchant, Director and Head of Africa, Convergence Blended Finance

Convergence has recently published its State of Blended Finance: Climate Edition which investigates climate blended finance trends across the overall market in 2024, including deal flow, investor activity, and regional dynamics.

Jaco Beerends, Deputy Head of Mission, Embassy of the Kingdom of the Netherlands, added:

“Our role is to support projects in their critical early stages, providing the confidence and structure needed to get NbS transactions off the ground”

– Jaco Beerends, Deputy Head of Mission, Embassy of the Kingdom of the Netherlands

The keynote address by Myrko Webers (Country Manager Kenya, VEI/WWX) showcased Water as Leverage – a concrete NbS initiative demonstrating how strategic partnerships and integrated planning can deliver impact at scale.

“Water as Leverage (WaL)” is a financing strategy initiated by the Dutch government that places water management and climate adaptation at the heart of urban resilience efforts. By developing bankable, integrated, and innovative project proposals, WaL aims to unlock billions in investment from financial institutions, complementing the millions invested during early project development.

Breakout Sessions

Participants joined focused breakout sessions on impact, blended finance, and carbon markets, each designed to foster dialogue and share practical insights.

![]() Impact – led by Karene Melloul (CEO, Kenzugi) and Mwangi Wamae (Co-founder, Kenzugi) highlighting regenerative farming and tangible on-the-ground outcomes.

Impact – led by Karene Melloul (CEO, Kenzugi) and Mwangi Wamae (Co-founder, Kenzugi) highlighting regenerative farming and tangible on-the-ground outcomes.

![]() Finance – led by Marcel Ham (Principal, Rebel Advisory East Africa), exploring how blended finance structures can help overcome barriers to NbSinvestment.

Finance – led by Marcel Ham (Principal, Rebel Advisory East Africa), exploring how blended finance structures can help overcome barriers to NbSinvestment.

![]() Carbon Markets – led by Elijah Isabu (Manager Carbon Markets, FSD Africa) and Umy Adam (Co-founder of Umita, a partner for the Papariko project with Vlinder), discussing how fair and inclusive carbon markets can support the scale-up of NbS projects.

Carbon Markets – led by Elijah Isabu (Manager Carbon Markets, FSD Africa) and Umy Adam (Co-founder of Umita, a partner for the Papariko project with Vlinder), discussing how fair and inclusive carbon markets can support the scale-up of NbS projects.

“For carbon markets to truly scale nature-based solutions, they must be built on fairness, transparency, and community ownership. When local people benefit directly, carbon finance becomes a catalyst for both climate resilience and inclusive development”

– Elijah Isabu, Manager Carbon Markets, FSD Africa

Rebel Foundation x Kenzugi Partnership

During the networking reception, Ingwell Kuil (Director, Rebel Advisory East Africa) announced that the Rebel Foundation will extend catalytic funding to Kenzugi, a Kenyan regenerative farming initiative advancing a nature-positive economy.

This support will help scale up three key components of Kenzugi’s work:

1. Landscape restoration pilot – advancing silvopasture approaches to rehabilitate degraded land.

2. Integration of smallholders – strengthening the honey value chain through inclusive partnerships.

3. KOOL Tool – applying data-driven design to optimise land use and enhance productivity.

This partnership exemplifies how targeted, early-stage finance can de-risk innovation and unlock larger-scale investment in NbS.

“This catalytic funding gives Kenzugi the runway to prove what regenerative farming can achieve at scale. It allows us to demonstrate a model that restores landscapes, strengthens rural livelihoods, and builds a truly nature-positive economy”

– Karene Melloul, CEO, Kenzugi

Looking ahead

The workshop reinforced a shared commitment among a diverse group of stakeholders to mobilise private finance for nature, bridging the gap between environmental ambition and investable opportunities.

Rebel Advisory East Africa remains committed to supporting financial institutions, investors, and governments in developing bankable, scalable NbSmodels that advance both climate resilience and sustainable economic growth.