Climate Adaptation Finance Masterclass

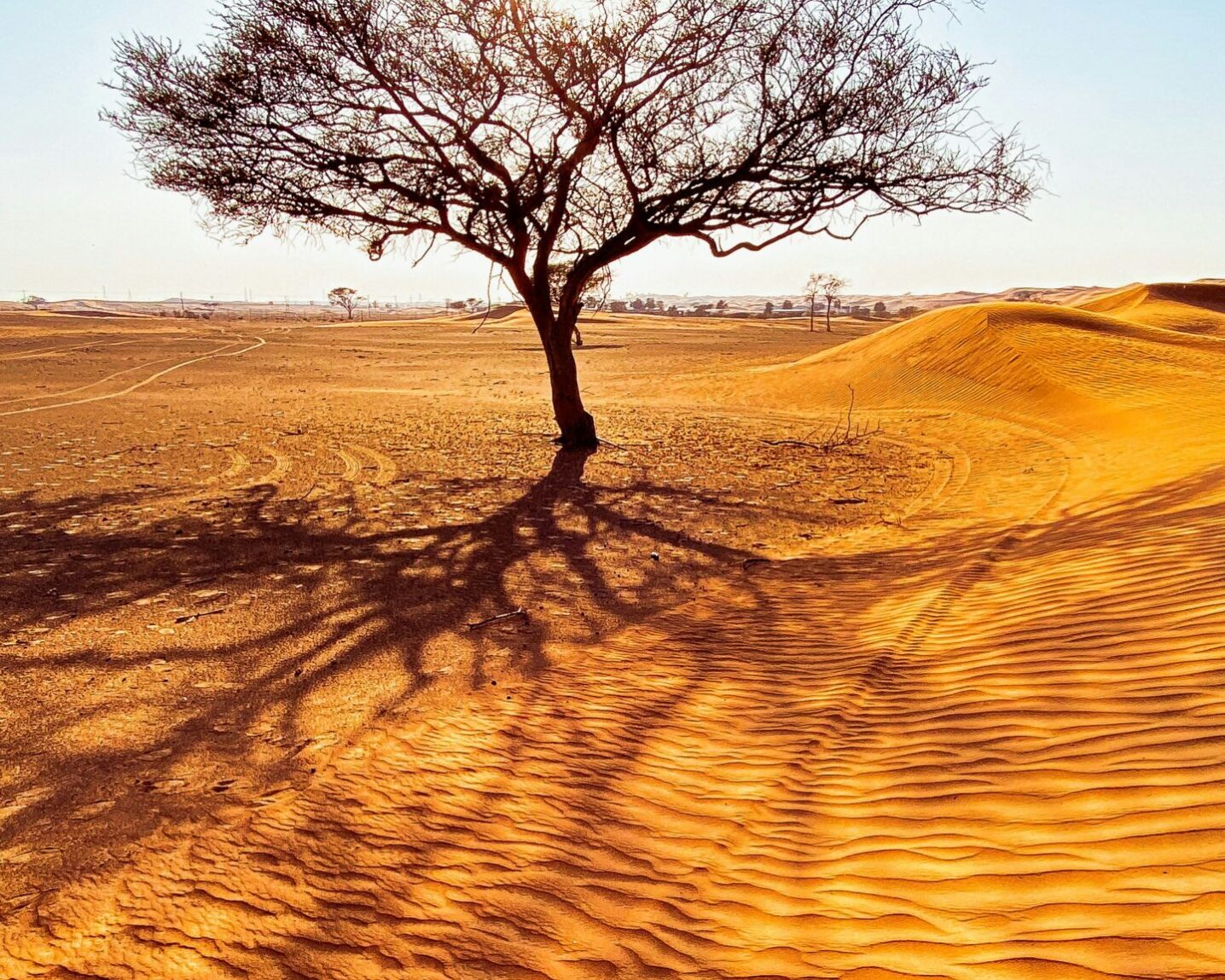

Realized in Kenya

The Global Center on Adaptation (GCA) and the European Bank for Reconstruction and Development (EBRD) have partnered to build capacity within the financial sector by developing a comprehensive Body of Knowledge and a series of interactive Masterclasses. These initiatives aim to empower financial institutions with the tools, insights, and practical strategies needed to understand, assess, and manage climate risks effectively. To deliver this effort, Rebel collaborates with the Frankfurt School of Finance and Management and Haskoning, combining technical expertise, financial know-how, and real-world application.

The challenge

Despite the growing urgency of climate change, private sector investment in climate adaptation has remained limited, particularly in regions like Africa where the need is most acute. Public funding continues to dominate adaptation finance, while private actors face major barriers to engagement. These barriers include high upfront costs, uncertain returns, and a lack of robust data on climate impacts and adaptation effectiveness. Moreover, adaptation projects are often viewed as delivering mostly social benefits, with limited financial gains deterring capital flows. Many financial institutions also lack internal knowledge, tools, and incentives to identify, evaluate, and finance adaptation initiatives, leaving a critical gap in the global response to climate resilience.

The approach

In response to these challenges, GCA and EBRD initiated the development of a curated Body of Knowledge and targeted Masterclasses aimed at building the capacity of financial institutions to navigate climate adaptation finance. These resources are designed to be hands-on and solution-oriented, grounded in real case studies and practical examples. The program helps institutions identify material climate risks, assess their portfolio exposure, evaluate adaptation opportunities, and align financial strategies with long-term climate resilience goals.

Crucially, it also highlights pathways for structuring and de-risking adaptation investments, thereby catalyzing greater private sector involvement.

Rebel has played a key role in delivering actionable insights to financial institutions through tailored Masterclasses, helping translate complex climate science and adaptation theory into pragmatic financial strategies.

Impact

By combining our understanding of investment design, climate risk, and private finance, we’ve helped close the knowledge gap and support the creation of stronger, adaptation-aligned investment pipelines.

P